Greed and Gurus: The hidden elements in Canada's housing crisis

Most Canadians will struggle to own a home if the average Canadian believes that you should be able to flip a house a few years after moving in for retirement level profits.

This pervasive belief and the gurus who push it on TV Real Estate shows, seminars, and podcasts are the hidden elements in the Canadian housing crisis.

The biggest barrier to you owning a home may not be government bureaucracy, the economy or assorted development bottle necks. Instead, it may be your neighbour’s belief that selling an overpriced home is perfectly normal.

In 2018, when I moved back to my hometown in the GTA, I noticed that the houses were overpriced. Selling a 40-year-old house that was falling apart for $800,000 was perfectly normal. On one listing, the seller was so confident that they could get that price that they didn’t even bother to spread the bed for the real estate photos.

Each time I mentioned that these homes were overpriced, I was met with the same response. I was told that they weren’t, and that this was just how the market worked.

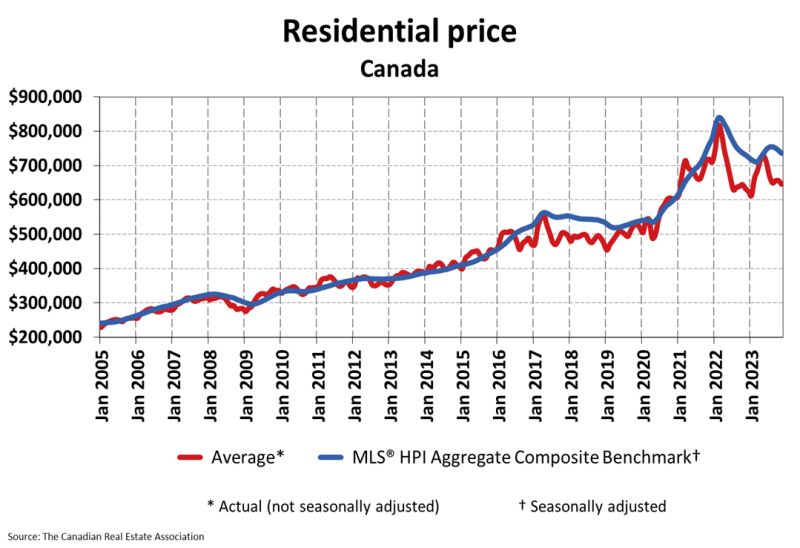

“The market” at work can be seen in statistics provided by the Canadian Real Estate Association about house pricing trends from 2005 to the present. In 2005 a $200,000 house was doable. Now, 800,000+ is the norm.

Chart A from https://stats.crea.ca/en-CA/

Part of me wanted to believe that I just didn’t understand how the market worked. After all, I’m in my late forties and have never owned a home.

Then thankfully, the Toronto Star came along to confirm what I had suspected was true. In a March 21, 2019 article, investigative reporter Marco Chown Oved confirmed that not only were homes in the GTA overpriced, but that the prices were being driven up by criminal elements.

The confirmation that homes in the GTA were overpriced was good, but blaming the crisis on organized crime alone is just too easy. Four years after this article was published, two other elements have emerged that are equally responsible for driving up the prices of houses. These two elements are greed and gurus.

We all love our gurus whether we admit it to ourselves or not. We want to be able to do what our gurus can do. The gurus driving up the market often come in the form of a savvy couple on TV who buy houses, fix them up if needed, add some upgrades, and then flip them for an enormous profit.

Because that’s what gurus do on TV, we have come around to thinking that we’re supposed to do it too. The gurus have convinced average Joe who would have sold his house for a 100,000 profit to sell it for a 200,000 profit.

The gurus did not accomplish this overnight, but over several years of continual programming. In a watch-me-do it and you can do it too reality TV driven version of reality, the gurus have normalized overpriced housing.

This has created a wink-wink real estate market, where everyone is winking at everyone else, like a secret wealth building joke that everyone is in on.

Except it is no joke at all and the culmination of years of this has contributed to a housing crisis.

When no one was paying attention, the access to housing for everyone camp and the sell my house for whatever I want camp were on a collision course. The collision eventually took place and the carnage is proving to be harder to clean up than anyone expected.

Due to the increase in tent cities and hard-working people sleeping in their cars, the government is now scrambling to come up with solutions to the crisis.

Many solutions have been put forward, and are being put forward as we speak. They include more government funding, municipalities stepping up to increase new home construction and wartime style Strawberry box houses; a basic house with a simple design that was used for workers during World War two.

However, in the middle of all these solutions, we would be remiss to not take a hard look at the elements of greed and gurus that are perpetuating the problem while we’re trying to fix it.

To not address it is like sleeping with your window open in December while filling your house with energy saving solutions.

The Oxford Dictionary defines greed as excessive desire, especially for food or wealth.

Greed is what makes a person sell a house worth $350,000.00 for $600,000.00. Though several forces may exist that the homeowner deems valid reasons for doing so, at the end of the day, greed is still greed. Saying that “the market made me do it” just won’t cut it any more while your neighbour is sleeping in their car.

Now that we are actively seeking solutions, let us also be willing to admit that any plan to address the housing crisis without also addressing the hidden elements of greed and gurus will fail.

As long as this greed continues to drive up housing prices, more and more Canadians will struggle to achieve a basic human right, a place of their own to live.